The Bank of England will impose “temporary” limits on stablecoin holdings to protect credit availability, but has not specified when the caps will be lifted, Deputy Governor Sarah Breeden confirmed on Tuesday.

The central bank plans limits of £10,000-£20,000 for individuals and £10 million for businesses on systemic stablecoins used for payments.

Breeden stated, “we would expect to remove the limits once we see that the transition no longer threatens the provision of finance to the real economy.”

However, the consultation paper arriving later this year provides no timeline or metrics defining when that threshold would be met.

The approach contrasts with the U.S., where Congress passed the GENIUS Act in July, establishing federal stablecoin regulation without ownership caps.

Tom Duff Gordon, Vice President of International Policy at Coinbase, earlier told the Financial Times that “imposing caps on stablecoins is bad for UK savers, bad for the City and bad for sterling,” noting that no other major jurisdiction has deemed caps necessary.

Deposit Outflows Threaten Credit

According to Breeden, the Bank of England will provide accounts to systemic stablecoin issuers, allowing them to hold reserves at the central bank and earn returns by investing a portion in short-term UK government debt.

The consultation will outline a potential liquidity facility to help solvent issuers monetize assets during redemption pressure.

Breeden emphasized that this position puts the Bank in the role of “banker to systemic issuers,” thereby avoiding reliance on commercial banks for accounts.

The arrangement mitigates financial stability risks associated with the interconnectedness observed during Circle’s USDC de-pegging in March 2023, following the failure of Silicon Valley Bank.

Earlier this month, Governor Andrew Bailey explained that rapid deposit outflows into stablecoins could cause “a precipitous drop in credit for businesses and households” if banks cannot quickly scale wholesale financing from insurers and funds.

Speaking with Cryptonews, Varun Paul, former Head of the Fintech Hub at the BoE, noted Bailey is “lifting the hood on the deep economic and policy questions” surrounding stablecoins for the first time, including whether greater separation between payments and credit creation is sustainable.

Paul added that Bailey “opened the door to using some regulatory features for non-bank stablecoin issuers—perhaps a stablecoin can have FSCS protection if the issuer contributes to the scheme.“

The Bank plans to expand settlement assets in its Digital Securities Sandbox to include regulated stablecoins.

Fifteen firms, including Euroclear, HSBC, J.P. Morgan, and the London Stock Exchange Group, are preparing to launch trading venues potentially as early as next year.

Industry Pushback Intensifies

Just like Gordon, Simon Jennings, executive director of the UK Cryptoasset Business Council, also argued that “limits simply don’t work in practice” because stablecoin issuers cannot monitor token holders in real-time.

Enforcing caps would require costly systems, such as digital IDs or constant wallet coordination.

The restrictions deepen tensions between the Bank and Treasury as Chancellor Rachel Reeves committed back in July to “drive forward developments in blockchain technology, including tokenised securities and stablecoins.“

While the UK government is being criticized for its approach to regulation, Reform UK leader Nigel Farage has recently pledged to slash crypto capital gains tax from 24% to 10% and establish a £5 billion Bitcoin reserve if elected, calling the Bank’s stablecoin caps “frankly ridiculous.” Reform currently leads in numerous polling projections.

Breeden acknowledged coordination challenges, noting the UK government will appoint a Digital Markets Champion to coordinate private sector work.

The government is also issuing a digital gilt instrument on a Sandbox platform to catalyze the adoption of DLT.

She noted that the Bank’s new wholesale payments infrastructure, RT2, already supports settlement using tokenized central bank money.

Synchronization functionality will be launched next year in the Synchronization Lab for testing real-world use cases before its production deployment.

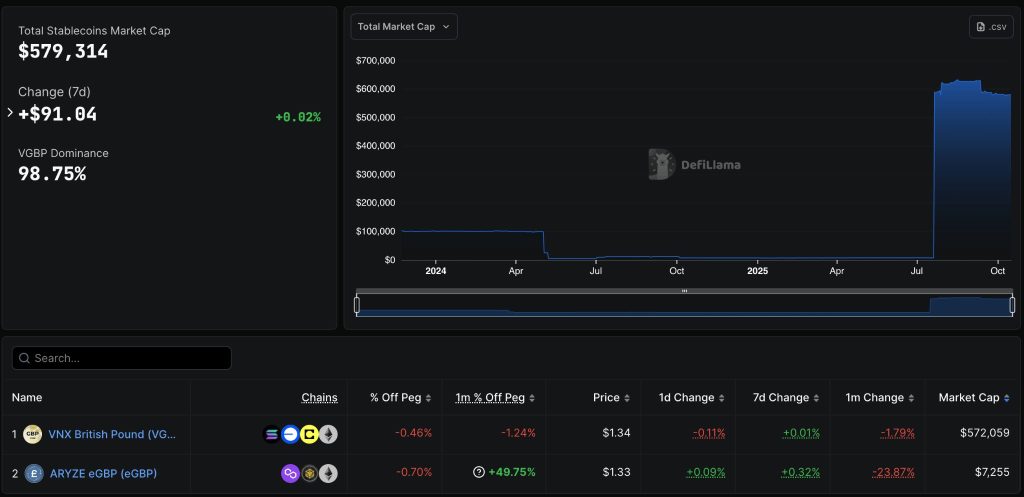

Notably, this global adoption is growing as the worldwide stablecoin market has expanded to exceed $300 billion; yet, sterling-pegged tokens remain below $580,000, compared to $473 million in euro-linked stablecoins, according to DeFiLlama.