Cardano price is approaching a decisive breakout zone, with historical Q4 trends hinting at a potential rally as participants watch key levels between $0.60 and $0.90.

Cardano price is once again stirring anticipation across the market as participants eye a potential year-end revival. After months of consolidation, ADA’s structure is tightening near a decisive range.

With technicals showing signs of compression and sentiment slowly improving, market watchers are beginning to wonder if ADA Cardano is setting the stage for another seasonal rally just like its previous cycles.

Cardano Seasonal Analysis Hinting at a Q4 Rally

Historical trends show Cardano often gaining strength during the final quarter of the year. The seasonal chart shared by TapTools indicates that ADA’s price action in previous cycles followed a similar trajectory, periods of mid-year stagnation before strong Q4 expansions. With 2023’s late-year recovery mirroring earlier bullish setups, traders are watching whether 2025 can repeat this familiar cycle once again.

Cardano mirrors its historic Q4 performance patterns. Source: TapTools via X

The resemblance between current and past fourth-quarter rallies implies that momentum could be building quietly under the surface. Seasonality doesn’t guarantee performance, but the setup suggests that ADA Cardano price could be preparing for one of its cyclical runs as historical strength re-emerges heading into year-end.

Cardano’s Main Breakout Level Stands at $0.90

Cardano price is currently pressing against the upper boundary of a large symmetrical triangle that has been forming for months. The breakout level remains clear; a decisive close above $0.90 could unlock the next major leg higher, with the next zone of interest sitting near $1.88. On the downside, the broader structure remains protected as long as the price stays above the rising trendline support near $0.62.

ADA nears a key breakout zone, with $0.90 standing as the level to beat. Source: Ali Martinez via X

Ali Martinez’s chart pattern represents a textbook consolidation before continuation, and the market is again testing its patience phase. Participants are eyeing $0.80 to $0.90 as the key validation range for the next impulsive move, while holding above current levels keeps the bullish scenario alive.

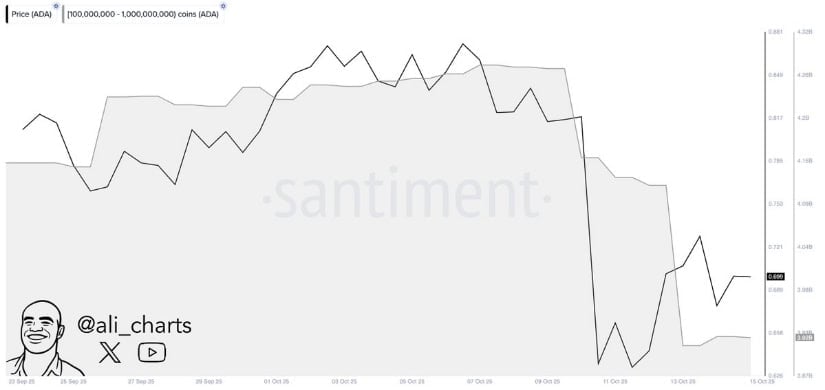

On-Chain Data Reflects Whale Distribution

Despite some bullish probabilities, recent data highlights that over 350 million ADA were sold by large holders during the past week, a shift that introduces short-term caution. Such heavy outflows from whale wallets often signal profit-taking or repositioning, reducing immediate upside pressure.

Over 350 million ADA moved out of whale wallets this week. Source: Ali Martinez via X

This wave of distribution contrasts with the otherwise constructive technical picture. While long-term investors may view this as a healthy reset, it also means that short-term rallies could face resistance as liquidity redistributes.

Near-Term Risk Leans Bearish

Cardano’s short-term chart reflects a struggle to maintain higher lows, with the market currently hovering near $0.65. The visual projection points to a possible retest of $0.74, a zone that aligns with previous structural supports. Breaking below it could expose $0.62 and even $0.60 if selling pressure extends.

Cardano price struggles to hold higher lows, with bears eyeing a potential retest of the $0.74 support zone. Source: smcapitalclub via X

Analyst smcapitalclub’s structure resembles a rolling top formation, suggesting that bulls must reclaim $0.86 to $0.88 quickly to avoid deeper pullbacks. As things stand, Cardano price momentum remains neutral to bearish unless a clear reversal candle appears above the neckline.

Cardano Technical Analysis

Cardano price is currently testing a pivotal resistance zone between $0.68 and $0.70. A successful breakout and daily close above this range could propel the price towards $0.80 to $0.85 in the short term. Conversely, rejection from this band could trigger a minor pullback towards $0.62 to $0.60, keeping price within a weak environment.

ADA Cardano faces a key test between $0.68 and $0.70, where a breakout could reignite short-term bullish momentum. Source: CryptoPulse via X

The setup remains balanced for now, but participants are closely monitoring this compression zone for directional clarity. A clean break above $0.70 could reestablish bullish momentum, while failure to do so may extend Cardano’s consolidation phase a bit longer.

Final Thoughts: Cardano Price Prediction

Cardano’s current setup carries both opportunity and caution. The market remains trapped within a well-defined range, yet the broader structure still supports a gradual recovery if the price holds above $0.62. The $0.70 to $0.90 corridor remains the main battleground. Reclaiming and sustaining above this area could signal the start of a larger breakout towards $1.20 and potentially $1.80 in the next expansion phase.

However, short-term volatility should not be ignored. If the market fails to defend mid-range supports, ADA Cardano price could revisit deeper zones before rebuilding momentum. Overall, the Cardano price prediction still leans constructive for Q4, provided accumulation holds steady and buyers manage to confirm higher highs.