In brief

- Released files related to convicted sex offender and financier Jeffrey Epstein contain numerous crypto mentions.

- New revelations show correspondence with notable early crypto builders and backers.

- Other files point to Epstein’s early investments into notable crypto companies.

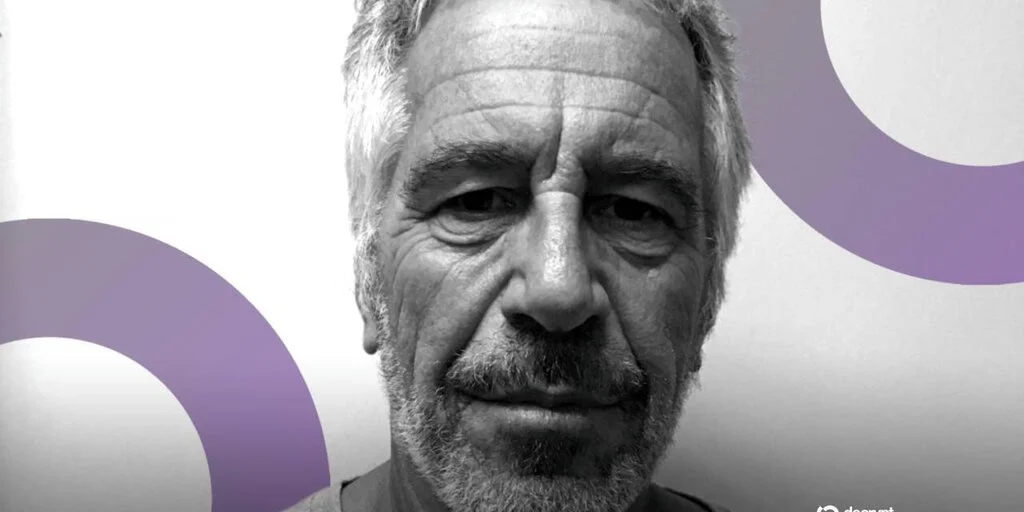

A search through the trove of files related to convicted sex offender Jeffrey Epstein provides thousands of results related to crypto and Bitcoin, highlighted by Epstein’s early involvement and awareness of notable crypto projects and protocols.

Over the course of the week, Decrypt has highlighted some of the largest stories that emerged from the millions of files released last week by the Department of Justice, including how Epstein invested in Coinbase and Bitcoin firm Blockstream, and had a very close relationship with Tether co-founder Brock Pierce.

But there’s plenty more in the files, including references to major crypto players like Ethereum co-founder Vitalik Buterin and Strategy co-founder and Executive Chairman Michael Saylor. Here’s a look at the most surprising crypto mentions from both batches of the Epstein files released by the Department of Justice.

Coinbase investment

Jeffrey Epstein was an early investor in publicly traded crypto exchange Coinbase, new emails show.

The convicted sex offender invested $3 million in 2014 and was introduced to the opportunity by Tether co-founder Brock Pierce and his investment firm, Blockchain Capital. However, Blockchain told Decrypt that Epstein ultimately invested independently, not through the firm.

Based on the emails, it’s apparent that Coinbase co-founder Fred Ehrsam was personally aware of the investment, which came years after Epstein’s conviction. The investment was made when Coinbase was valued around $400 million; the publicly traded company is now worth $44 billion.

In 2018, Epstein sold around half of his investment back to Blockchain Capital, emails show.

Bitcoin, crypto taxes

Epstein was seeking clarification about Bitcoin regulation and taxes as early as 2018, emails from the first trove of files released by the Department of Justice revealed.

In conversation with former Trump strategist Steve Bannon, Epstein suggested that the Treasury Department should create a voluntary disclosure form for crypto gains in an attempt to “fuck all the bad guys.”

Later that year, Epstein noted that crypto should be thought of similarly to the internet, and handled with “coordinated understandings” and international agreements.

Brock Pierce and Epstein

Tether co-founder Brock Pierce communicated with Epstein on multiple occasions about cryptocurrency and women, with all correspondence taking place after Epstein’s 2008 conviction, according to the latest batch of files released by the Department of Justice.

At one point, Pierce told Epstein that “he had a great time with the girls,” and Epstein also instructed the crypto entrepreneur to “find him a present” when he was traveling abroad.

Furthermore, Epstein communicated to both sides of an alleged relationship that Pierce had with an individual that Epstein called “his assistant.” The individual allegedly declined a marriage proposal from Pierce.

Files also uncovered a meeting at Epstein’s Manhattan townhouse between Tether co-founder Brock Pierce and former Harvard President Larry Summers.

The two apparently utilized the disgraced financier’s dwelling to chat about Bitcoin, with Summers noting that he saw “opportunities,” but was concerned about the potential damage to his reputation that Bitcoin losses could create.

Blockstream investment

Epstein was an investor in Bitcoin infrastructure firm Blockstream, according to newly revealed emails and a confirmation from early Bitcoin developer and Blockstream co-founder Adam Back.

“Blockstream met with Jeffrey Epstein, who was described at the time as a limited partner in [Joi] Ito’s fund,” wrote Back. “That fund later invested a minority stake in Blockstream.”

The longtime Bitcoiner and his Blockstream co-founder Austin Hill were also both invited to Epstein’s island in 2014, according to newly revealed files from the DOJ. But whether or not the trip ever happened is unclear from the emails, and Back did not respond to Decrypt’s request for comment.

In his confirmation of Epstein’s investment, the Blockstream co-founder added that the firm “has no direct nor indirect financial connection with Jeffrey Epstein, or his estate” at present time.

A Bitcoin core developer and former contributor to Blockstream urged Back to resign this week after the new files were released.

Epstein and Thiel talk Bitcoin narrative

A 2014 email from Jeffrey Epstein to famed tech investor Peter Thiel questioned Bitcoin’s narrative.

“There is little agreement on what Bitcoin is,” wrote Epstein. “Store of or intrinsic value, (if any) currency, property, architecture, payment system. Etc.”

The reply followed a question from Thiel about an increasing “anti-BTC pressure” that might be growing within the U.S. government.

At the time, Bitcoin was trading around $691 per coin. It’s since jumped dramatically, recently trading around $70,000 after peaking above $126,000 last October.

Michael Saylor slammed

Bitcoin bull and Strategy Executive Chairman Michael Saylor was called a “creep” by Epstein’s publicist Peggy Siegal in an email to the convicted sex offender in 2010.

“He has no personality. Sort of like a zombie on a drug,” wrote Siegal of Saylor. “I walked him around and he was so weird that even I ran away from him.”

According to the email, Saylor provided $25,000 for a spring gala for the “opportunity to get his name on [the] invite and meet a hip group.”

The email was sent more than a decade before Saylor’s software firm would make its first BTC purchase, with the firm amassing nearly $50 billion worth of the asset and inspiring a wave of followers to adopt a crypto treasury model.

Questionable ethics

Despite his 2008 conviction for procuring a child for prostitution and soliciting a prostitute, a decade later, Epstein was concerned about the ethics of funding projects in the crypto space.

“I am more than happy to fund things but as I am high-profile, it can’t be questionable ethics,” Epstein wrote in an email to Bitcoin researcher Jeremy Rubin, who replied telling the financier that there’s a “grey area between pump and develop.”

“Their deal is to pump the currency,” said Epstein of investors in the space. “It is dangerous.”

A “better” Vitalik Buterin

Ethereum co-founder Vitalik Buterin’s name is found in the Epstein files, but not as a result of any direct connections or correspondence with the disgraced financier.

Instead, the latest batch of emails shows an email Epstein received from Masha Drokova that highlights that the Russian investor had found a “super smart and young blockchain enthusiast in Russia.”

“He can be better than Vitalik Buterin if he focuses on technology,” Drokova added.

Although she offered to connect Epstein to the Russian individual, it is not clear who the technologist was, or whether or not they were ultimately linked to Epstein.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.